Long Collar Option Strategy

1 strike price also called the exercise price.

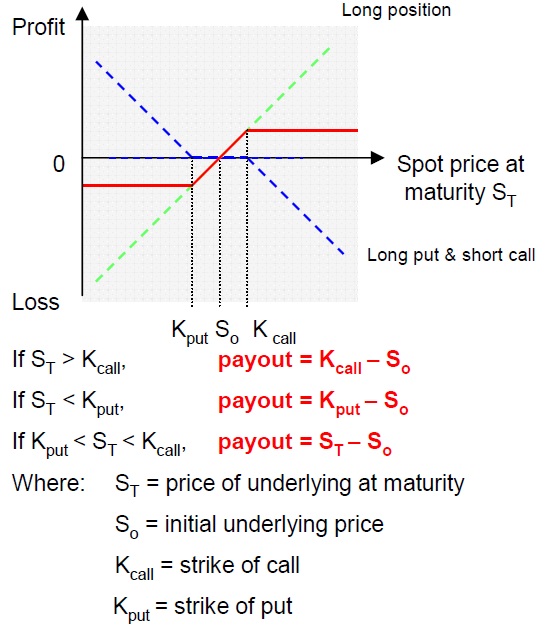

Long collar option strategy. What is collar strategy. See detailed explanations and examples on how and when to use the collar options trading strategy. Collar option strategies are a protective strategy that is implemented on a long stock position. An investor can create a collar position by purchasing an out of the.

What is costless or zero cost collar. See detailed explanations and examples on how and when to use the costless or zero cost collar options strategy. 40 detailed options trading strategies including single leg option calls and puts and advanced multi leg option strategies like butterflies and strangles. Online option strategy analyzerstrategy screenerscreen for covered call covered put screeneroption priceroption calculator.

A long straddle involves going long in other words purchasing both a call option and a put option on some stock interest rate index or other underlying. Protective collars are considered a bearish to neutral strategy. The loss in a protective collar is limited as is the upside. For example lets say that jack.

The components of the option chain columns from left to right.