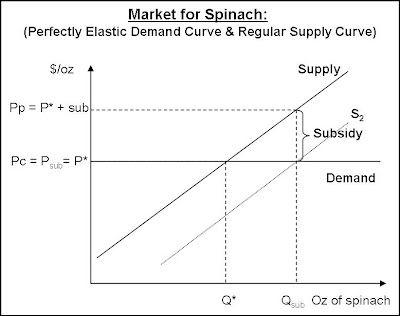

Perfectly Inelastic Supply Tax Deadweight Loss

Elasticity of demand is equal to the percentage change of quantity demanded divided by percentage change in price.

Perfectly inelastic supply tax deadweight loss. Lecture on the effects of a per unit tax. The lecture material is developed on the assumption that students have previously been introduced to step function market. A landlocation value tax lvt also called a site valuation tax split rate tax or site value rating is an ad valorem levy on the unimproved value of land. When should you want demand to be elastic vs.

Learn how to apply elasticity of demand to real world scenarios. Peds in combination with price elasticity of supply pes can be used to assess where the incidence or burden of a per unit tax is falling or to predict where. C jason welker 2009 1 zurich international school ap microeconomics. Exam study guide format.

60 mc questions worth 6667 of total. 70 minutes to answer.